Home

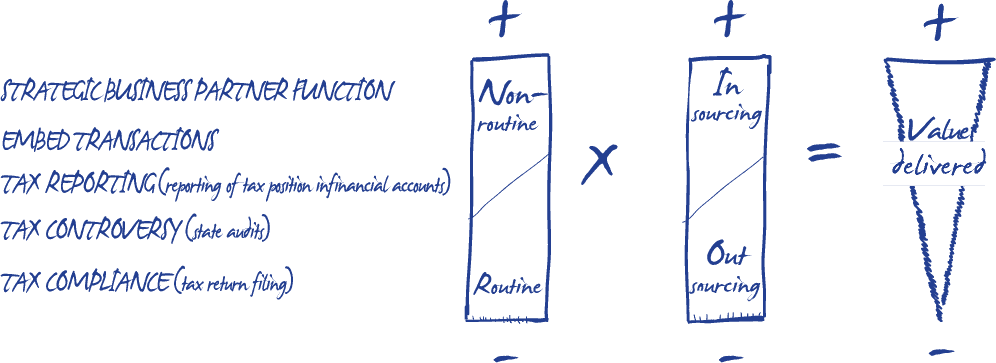

Longbows enables companies to insource a tax director on the basis of demand. The benefits of insourcing without addition to the payroll!

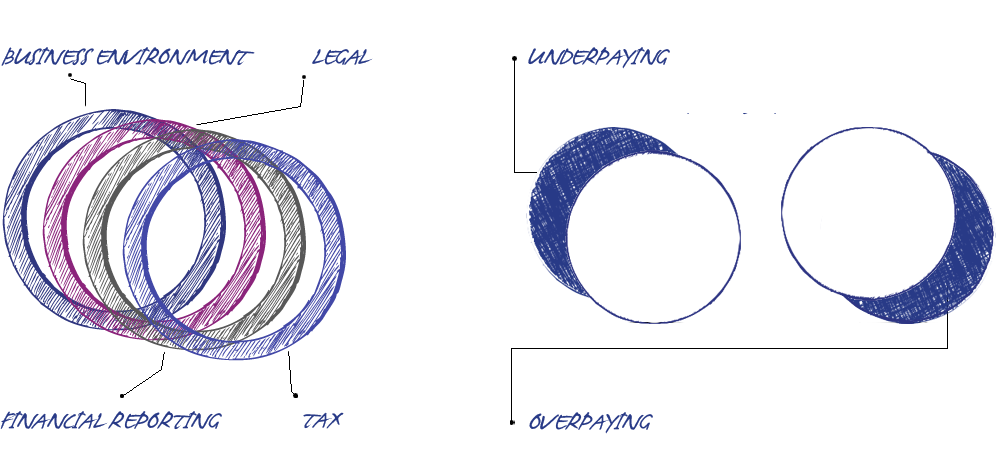

Globalisation and digitalization lead to more complex supply chains and more cross-border transactions. Specifically for the tax function this means that opportunities and threats lie ahead. You need a strategic business partner to step in and enable your business to grow ensuring that exposures are minimalized and you do not miss out on opportunities. The size of your business may not yet warrant a full-time tax director, that is why we have started Longbows. In addition to an interim role, we envisage growing with your company and demonstrate the value add of inhouse tax counsel.